Thematic investing 101: a beginner’s guide

Explore the basics of thematic investing with Beewise.

Thematic portfolios are a type of investment strategy that focuses on a particular theme or trend that is expected to have long-term growth potential. These themes can be based on various factors such as industry trends, societal changes, technological advancements, or environmental concerns. In this blog, we’ll explore the benefits of thematic investing and how to choose the right thematic portfolio for you.

Benefits of thematic investing

1. Potential for higher returns

Thematic portfolios hold the potential for greater returns compared to traditional portfolios, as they focus on companies expected to thrive in the long run. For instance, a portfolio centered around renewable energy may comprise companies specializing in solar or wind power technologies.

2. Diversification benefits

Since thematic portfolios invest in companies across different industries and sectors, they typically have diversification benefits. This can be a great investment benefit, as it can help reduce the overall risk of your portfolio.

3. Alignment with personal values

A third benefit that some might appreciate more than others, is the fact that thematic investing allows investors to align their investments with their personal values. For example, an investor who is interested in the medical advancements may choose to invest in a healthcare-focused portfolio.

Choosing a thematic portfolio

If you’re interested in investing in a thematic portfolio, here are some steps to follow:

1. Choose a theme

Begin by identifying a theme that resonates with your personal values and exhibits long-term growth potential. For instance, if technology captivates your interest, search for portfolios that revolve around this specific theme.

2. Research companies

Research companies that are involved in your chosen theme. Look for companies that have a strong competitive advantage, solid financials, and a history of innovation.

3. Monitor your portfolio

Keep an eye on your portfolio and make adjustments as necessary. This can help ensure that your portfolio stays aligned with your chosen theme and remains diversified.

Getting started with the Beewise thematic portfolios

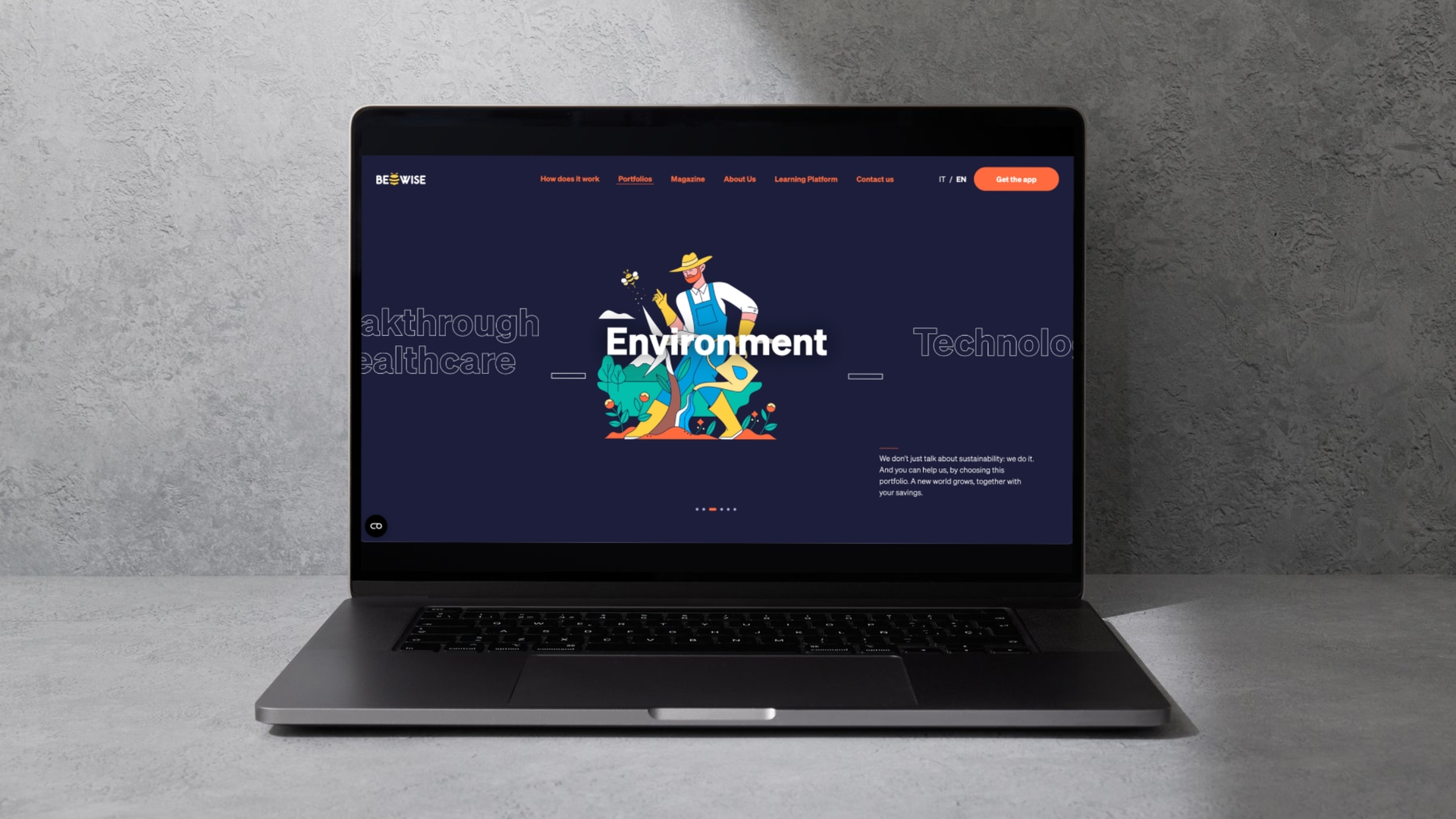

Investing for the first time in thematic portfolios with the Beewise investment app can be a great option. Beewise offers a range of thematic portfolios, including Environment, Technology, Smart Cities, Breakthrough Healthcare, and Future generations. These portfolios are designed to invest in companies that are focused on long-term growth themes and all have ESG criteria integrated in them.

By investing with Beewise, investors can benefit from the potential for higher returns and diversification benefits of thematic investing, while also supporting companies that are making a positive impact on society and the environment. The Beewise platform offers tools and resources to help investors monitor their portfolios easily and effectively. If you would like to give it a try, it is very easy to do so, since anyone with or without investing experience can start investing on their app starting 10 euros.